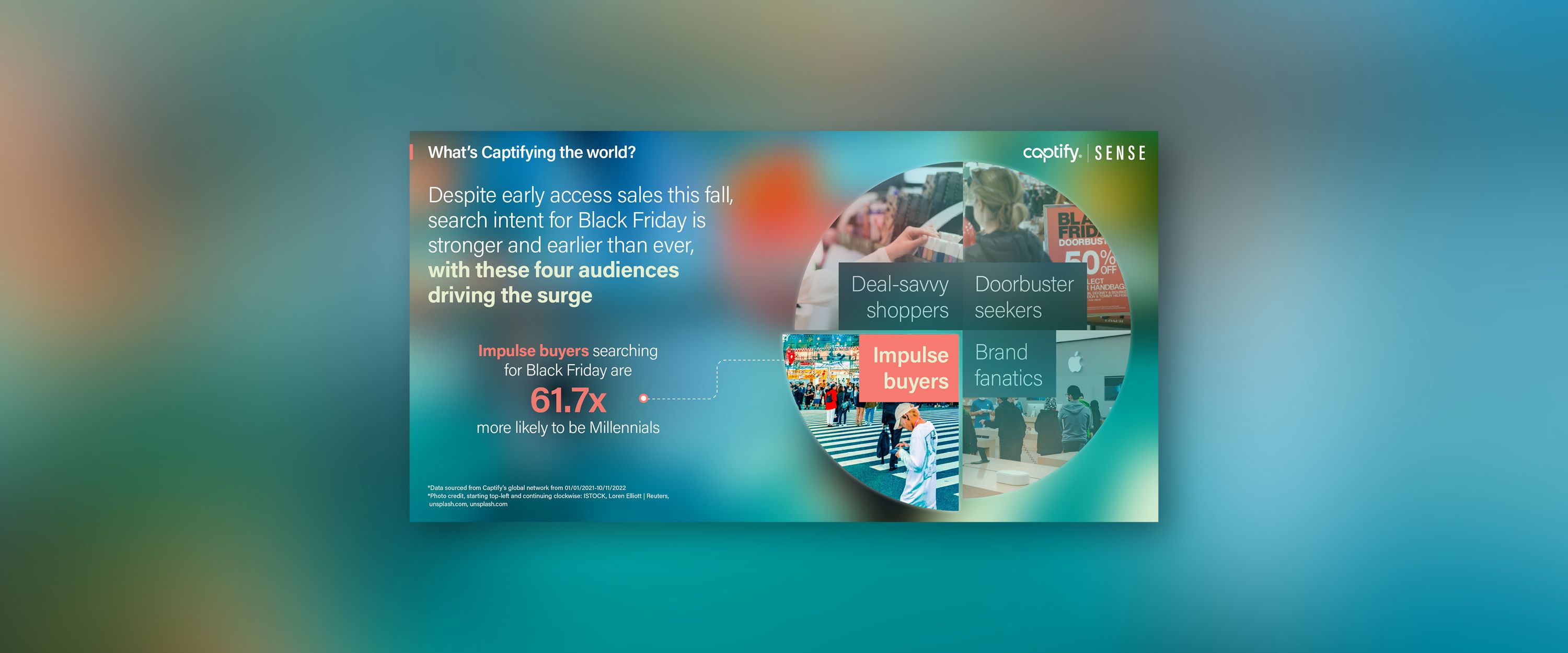

What’s Captifying the World: Despite Early Access Sales This Fall, Search Intent for Black Friday is Stronger and Earlier Than Ever, with these Four Audiences Driving the Surge

With Black Friday looming, retailers are bracing themselves for an uncertain period as inflation and economic challenges are causing consumers to re-prioritize their discretionary spending. With the 2022 shopping season looking very different to 2021, we took a look at the key audiences driving Black Friday intent this year, along with the best ways for brands to connect with them.

First, let’s take a look at how the holiday shopping season has begun.

Ready, set, shop

The peak shopping season launched early this year, with major retailers such as Amazon, Target and Walmart all kicking off their sales sooner than ever. Amazon debuted its second Prime Day (Early Access Sale) within six months. However, although the early shopping events lead to above average sales, they didn’t live up to expectations, setting up Black Friday to maintain its place as the reigning shopping moment of choice for consumers.

Black Friday is set to go off with a bang, with search intent kicking off as early as August 26 this year—13 days earlier than 2021 (much like what we saw with holiday gifting search intent). Not only was intent starting earlier in 2022, but the volume of searches is up too, driven by interest in discounts, with searches surrounding deals and promotions up by 19% YoY.

The four faces of Black Friday shoppers

In the lead-up to Black Friday, it’s crucial for retailers and brands to keep up with in-market and emerging audiences to uncover the motivations behind shopping behavior, and pinpoint purchase intent while it is relevant and fresh. For example, this year, only 10.4% of Black Friday searches are brand specific, while 42.8% are offer and promotion-based—almost doubling since 2021, suggesting that price is an increasingly important consideration for shoppers this year.

When deep-diving into Black Friday data, we identified four key audiences that brands should keep front of mind when building their messaging and targeting plans:

Deal-Savvy Shoppers —the ultimate deal drivers, who do extensive research on price cuts, deals and promotions. They are:

- Mainly searching across Beauty and Tech, with consumers 29.9x more likely to be beauty enthusiasts and 11.2x more likely to be in the process of replacing tech– reflecting that these two categories are front-runners in the Black Friday game

- Are currently in-market for products, being 22.1x more likely to be searching around making a purchase

- 20.9x more likely to be bloggers, suggesting that these shoppers are conducting extensive research to find the best deals

- 18.2x more likely to be searching for a new credit card, demonstrating their quest to spread payments, take advantage of promotional interest rates or introductory bonus rewards

Doorbuster Seekers— the consumers that thrive on shopping in stores, they ‘bust open doors’ to secure particular items at a special price. They are:

- 5.4x more likely to be suburban audiences, meaning it’s likely they have access to a variety of superstores, malls and retail warehouses

- 5.1x more likely to be commuters who are willing to travel to get their hands on the best deals and the products they want

- Primarily searching for Home & Garden products, with 3.3x more searches for this category—reiterating their profiles as dwellers of non-urban environments

Impulse Buyers—the last-minute searchers who do little planning. Price is less of a concern to them, but they may be swayed by offers. They are:

- Mostly interested in Gaming & Tech products–two verticals with big ticket items, suggesting that this audience may have a higher level of disposable income

- 61.7x more likely to be millennials, with this age group making impulse purchases 52% more than any other generation

- 14.9x more likely to be brand loyal, looking to take advantage of clubcards, rewards, loyalty points, etc. from their favourite brands

- 5.9x more likely to be searching around payday, indicating that these consumers are on the hunt for some retail therapy when those wages hit their bank accounts

Brand Fanatics—are obsessed with and loyal to brands. They do considerable research and are driven by quality and reviews, with their Black Friday searches focused on finding the best deals offered by their favorite brands and associated products. Brand fanatics are:

- Prioritizing Tech and Fashion ahead of other categories

- Not concerned with cost, with these consumers 36.4x more likely to search for luxury brands

- 25.3x more likely to be quality seekers– they are willing to fork out large sums of money for the brands they know and love, and the quality they offer

Key takeaways for brands for a successful Black Friday

Know your audience—Your target audience isn’t always who you would expect. Make sure you are building audiences from fresh, intent-rich data to find your most qualified consumer at scale. Search is a powerful signal of intent for marketers to tap into ahead of and during Black Friday to ensure the right consumer connections that will convert.

Personalize creative messaging—make sure your creative messaging matches the motivations of your target audience. For example, feature promotion-focused messaging when trying to reach a deal-savvy audience and ‘in-store promotions’ to connect with Doorbusters.

Meet your audience where and when it counts—it’s crucial to deploy targeting tactics that connect your brand with consumers during the right moment and as they are ready to make their purchase. The beginning of November is the ideal time for marketers to beef up their Black Friday messaging, with a strong final push during the sales period itself.

Now, what?

Make sense of what’s Captifying Black Friday for your brand, vertical or audience by requesting a demo of Sense, Captify’s Search Intelligence Platform—where you can unlock critical insights, discover untapped audiences and make more informed decisions around your Black Friday strategies.

*Data sourced from Captify’s global network from 01/01/2021-10/11/2022