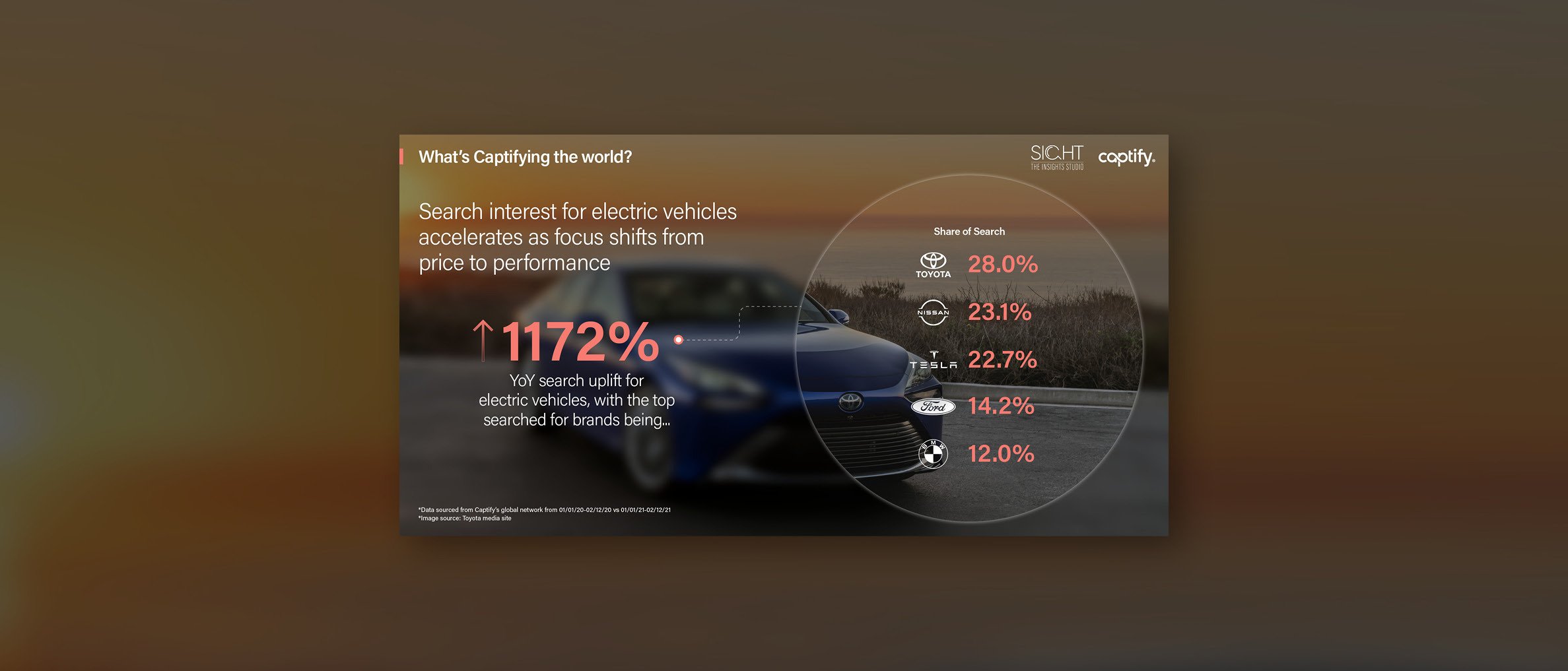

What’s Captifying the world: New launch announcements in Q1 accelerate search interest for electric vehicles, with focus shifting from price to performance

Despite auto sales slumping by a fifth in 2020, parts of the auto industry, such as the electric vehicle market, are actually revving up.

2020 global sales of electric vehicles rose by 43% to more than 3 million. This year is expected to be a pivotal one for the fast-growing electric vehicle (EV) sector, with both legacy auto brands and startups gearing up for an EV-led future.

Electric vehicles spark search interest

Captify analyzed billions of searches from Jan 1-Feb 12 2020 vs Jan 1-Feb 12 2021 to understand how shifting consumer priorities are impacting auto searches globally.

In contrast to the decline in gas and diesel vehicle searches, our platform identified an 1172% YoY search uplift for electric vehicles, suggesting that both Covid-19 and recent EV launches have positively impacted consumer intent and appetite.

Toyota leads brand share of search for EVs:

- Toyota—28%

- Nissan—23.1%

- Tesla—22.7%

- Ford—14.2%

- BMW—12%

Despite Tesla commanding nearly a quarter of the world’s EV sales in 2020, Toyota holds the highest brand share of search, which coincides with two recent announcements:

- In 2022, Toyota will release two new all-electric vehicles and one plug-in hybrid in the US

- By 2025, Toyota aims for 40% of its new vehicle sales to be electrified models, and by 2030 expects that to increase to nearly 70%

Automakers think big

Consumers are encouraged by increased EV affordability and availability.

Captify identified a growing demand for more versatile EV options, which is reflected in the share of search for different EV types, with Trucks and SUVs commanding the highest share of search:

- Truck—45%

- SUV—43%

- Mini Van—8%

- Hatchback—4%

- Crossover—1%

Furthermore, Captify’s search data reveals that over the past year consumer focus has shifted from price to performance and speed, as audiences actively compare different brands and models in the fast-growing EV market—with consumers making 6 EV searches on average.

Commuters plug into EVs

If you think Eco-conscious and Techy audiences are the only drivers of EV searches, think again.

Captify saw an acceleration in Commuters searching for EVs, as Covid-19 drives more consumers to rethink public transport in favor of private vehicles, revealing a new and emerging audience group for auto brands.

Data that informs your auto bounce back

In the absence of test drives and many dealerships being closed, auto intenders are searching more.

Brand marketers can lean on fresh and custom search data to understand consumer intent and inform more accurate media planning and activation strategies.

Measuring share of search is an explicit and powerful way to measure consumer interest and intent, linked to advertising investment—brands can use this to fuel their next marketing move and spot new opportunities for driving consideration with in-market auto seekers.

Get in touch to unlock the latest trends impacting your brand or vertical.

*Data sourced from Captify’s global network from 01/01/20-02/12/20 vs 01/01/21-02/12/21